Banking On Development, Cook County to Sell ‘Scavenger’ Properties

By Becky Vevea, WBEZ Chicago | May 1st, 2018 (Click here for the audio clip)

More than 3,000 vacant, tax-delinquent properties across Cook County go up for sale Tuesday at below-market rates, as part of a government program to get blighted homes back on the tax rolls.

It’s the latest move by the Cook County Land Bank Authority, which was formed in 2013 after the housing crash to deal with the tide of newly vacant and abandoned properties in Chicago and the suburbs. Officials there are hoping the addition of the 3,189 vacant lots to the land bank’s portfolio will further help break a cycle of speculation and lead to new development in neighborhoods damaged by the housing crisis.

It’s the latest move by the Cook County Land Bank Authority, which was formed in 2013 after the housing crash to deal with the tide of newly vacant and abandoned properties in Chicago and the suburbs. Officials there are hoping the addition of the 3,189 vacant lots to the land bank’s portfolio will further help break a cycle of speculation and lead to new development in neighborhoods damaged by the housing crisis.

Each year, the county holds an annual tax sale, in which private buyers can pay off a property’s back taxes in exchange for being able to collect payments from the original owner, with interest. County officials say the problem with that system is that the people who buy the debt often just collect the interest alone, while the blighted properties remain untouched.

“Their intention, from our standpoint, is the role of a speculator,” said Rob Rose, executive director of the land bank. “They’re not really trying to use this as a tool for acquiring properties or redeveloping neighborhoods.”

By contrast, the new move by the land bank aims to take the properties that have been in that cycle the longest — known as “scavenger” properties — and get them rehabbed and back on the tax rolls, Rose said. Buyers who purchase property from the land bank will have the back taxes and other fees forgiven in exchange for promising to redevelop the land within a year.

With 3,189 new vacant lots released today, the total number of properties available for purchase through the land bank is 8,500. Most of the land bank’s inventory is in neighborhoods hit hard by the housing crisis.

“We’re taking a step to be able to offer even more properties to the neighborhoods,” Rose said.

As of last year, the land bank says it had sold 400 homes to developers and has spurred 500 rehabs. Officials estimate that activity has brought $4.3 million back on to the tax rolls. Last year, the land bank also started selling directly to homeowners and began acquiring commercial property.

14th Annual Free Citywide Expo Hosted in Tuley Park

By Katherine Newman | April 25, 2018 (Click here for the original article)

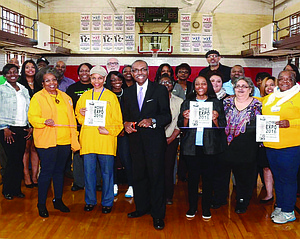

Chicago’s Chesterfield Community Council recently hosted their 14th annual free Citywide Home Expo at the Tuley Park Field House located on 90th St. and King Drive.

The Chesterfield Community Council is a community based non-profit organization that was started in 1955. The organization regularly organizes and participates in community activism along with hosting their annual Citywide Home Expo and the annual Silas Purnell College Expo.

The free Home Expo was designed to bring Chicagoans together with all the housing-related resources that are available to them.

The free Home Expo was designed to bring Chicagoans together with all the housing-related resources that are available to them.

“The motivation to do the Home Expo was that we just started seeing a bunch of abandoned houses and a bunch of houses that were deteriorating in our communities and we couldn’t figure out why? We did further research and found out that some people were losing their homes to foreclosure and some of the homes that were dilapidated were just because people weren’t aware of some of the programs that were available for them,” said Eli Washington, chairman of the Chesterfield Community Council Board of Directors.

The one-day expo featured a basement flooding seminar moderated by Kari Steele from the Metropolitan Water Reclamation District. A Home Security Seminar presented by the Chicago Police Department and other home security professionals was also on the agenda. Additionally, Judge Freddrenna Lyle moderated a Foreclosure Prevention Seminar.

There was also information relating to home improvement programs, property tax relief, senior housing, homebuyer initiatives, senior homeowners programs, lawn care, gardening programs and qualified contractors were on site.

Three programs that were represented at the Home Expo that Washington believes are very valuable services included the weatherization program which helps people with heating and cooling issues. The Cook County Board of Review was also represented and provided onsite help with lowering property taxes. The Cook County Land Bank Authority, which works to reduce and return vacant land and abandoned buildings back to the community, also provided assistance.

“Cook County Land Bank Authority is one of the best programs in this county. They provide a whole host of homes that they will sell to you for little or nothing and most of these homes are in pretty good condition,” said Washington. “The county is not trying to make a profit on these homes. They just want to get the house back on the market which is admirable and this program has been really successful at turning a lot of these houses around.”

Other participants in the Home Expo included: Neighborhood Housing Services; Chicago Historic Bungalow Association; Peoples Gas; Com Ed; City of Chicago; the Cook County Assessor; Home Depot and Menards.

To explore the available properties from the Cook County Land Bank Authority, visit cookcountylandbank.org.

To learn more about the Chesterfield Community Council, visit their website at www.chesterfieldcommunitycouncil.org.

Banking On Development, Cook County to Sell ‘Scavenger’ Properties

By Becky Vevea, WBEZ Chicago | May 1st, 2018 (Click here for the audio clip)

More than 3,000 vacant, tax-delinquent properties across Cook County go up for sale Tuesday at below-market rates, as part of a government program to get blighted homes back on the tax rolls.

It’s the latest move by the Cook County Land Bank Authority, which was formed in 2013 after the housing crash to deal with the tide of newly vacant and abandoned properties in Chicago and the suburbs. Officials there are hoping the addition of the 3,189 vacant lots to the land bank’s portfolio will further help break a cycle of speculation and lead to new development in neighborhoods damaged by the housing crisis.

It’s the latest move by the Cook County Land Bank Authority, which was formed in 2013 after the housing crash to deal with the tide of newly vacant and abandoned properties in Chicago and the suburbs. Officials there are hoping the addition of the 3,189 vacant lots to the land bank’s portfolio will further help break a cycle of speculation and lead to new development in neighborhoods damaged by the housing crisis.

Each year, the county holds an annual tax sale, in which private buyers can pay off a property’s back taxes in exchange for being able to collect payments from the original owner, with interest. County officials say the problem with that system is that the people who buy the debt often just collect the interest alone, while the blighted properties remain untouched.

“Their intention, from our standpoint, is the role of a speculator,” said Rob Rose, executive director of the land bank. “They’re not really trying to use this as a tool for acquiring properties or redeveloping neighborhoods.”

By contrast, the new move by the land bank aims to take the properties that have been in that cycle the longest — known as “scavenger” properties — and get them rehabbed and back on the tax rolls, Rose said. Buyers who purchase property from the land bank will have the back taxes and other fees forgiven in exchange for promising to redevelop the land within a year.

With 3,189 new vacant lots released today, the total number of properties available for purchase through the land bank is 8,500. Most of the land bank’s inventory is in neighborhoods hit hard by the housing crisis.

“We’re taking a step to be able to offer even more properties to the neighborhoods,” Rose said.

As of last year, the land bank says it had sold 400 homes to developers and has spurred 500 rehabs. Officials estimate that activity has brought $4.3 million back on to the tax rolls. Last year, the land bank also started selling directly to homeowners and began acquiring commercial property.

County Agency Plans to Redevelop Site Near Obama Center

By Danny Ecker, Crain’s Business Chicago | February 1, 2018 (Click here for the original article)

A Cook County agency designed to give new life to distressed houses is getting into the commercial property game, with its first such project just blocks from the site of the future Obama Presidential Center.

After acquiring the deed last month to the dilapidated former Washington Park National Bank building in Woodlawn, the Cook County Land Bank tonight will hold the first of three community meetings about the property to gather feedback on what it should become.

After acquiring the deed last month to the dilapidated former Washington Park National Bank building in Woodlawn, the Cook County Land Bank tonight will hold the first of three community meetings about the property to gather feedback on what it should become.

The 94-year-old structure on the southwest corner of 63rd Street and Cottage Grove Avenue is the first commercial test for the agency, launched by the Cook County Board in 2013 to help address the area’s massive inventory of foreclosed homes.

The agency says the 33,000-square-foot building next to the CTA Green Line Cottage Grove station has been vacant for more than two decades. The goal is for the property to be appraised at several million dollars after redevelopment, which would set a new high mark by the Land Bank’s metric of “community wealth created”—the difference between what it spent to acquire a property and what it’s worth after it’s rehabbed and has a family or business occupying it.

“This is a major first for us,” said Land Bank Executive Director Rob Rose, who joined the agency in 2015. “This is right in line with our mission.”

The Land Bank has focused mostly on speeding up the turnaround of distressed residential properties, mostly on the city’s South and West sides, by acquiring them and clearing away tax liens and other debt before selling them to developers. The homes are then rehabbed and ideally sold, restoring their property tax value to the county.

As of the end of 2017, the Land Bank had redeveloped 214 homes and also has helped turnaround four industrial properties, Rose said.

The agency is taking a similar approach to the Washington Park commercial property, which is about a mile west of where the Obama Foundation plans to build the president’s 22-acre legacy campus—a factor Rose called the “icing on the cake to know that this was the project we should take on.”

But instead of immediately submitting a request for proposals from developers, the Land Bank is running a community-led process with the help of the Metropolitan Planning Council, an urban planning and policy-focused nonprofit for the region.

The community meetings over the next few weeks will help shape the desired use for the run-down building before the Land Bank puts out an RFP in April that will lay out certain community guidelines any prospective developer must stick to. That’s different from the typical development process, in which developers submit plans before presenting them for feedback at community meetings.

“In many cases, the objections of the community are not incorporated into the final design, and in a lot of cases it’s just to check the box that ‘We talked to the community,'” Rose said. “We thought, why don’t we change that paradigm and incorporate that and get input early . . . that way, regardless of who is selected (to redevelop the property), we know they’re going to have community input embedded in what they do.”

Rose said the Land Bank has put about $5,000 into its acquisition of the Washington Park building so far, and he expects it will have spent more than $30,000 on it to secure the building and commission structural and engineering reports before issuing its RFP.

The Land Bank set the Washington Park bank opportunity in motion in December 2015 when it bought an option to acquire the deed to the property in a scavenger sale.

The agency spent months waiting out a redemption period during which the previous owner could have paid off the $3.7 million in back taxes and penalties on the property to retain ownership. When that didn’t happen, it cleared away the debt and last month was awarded the deed.

As of the end of 2017, Land Bank projects had created a total of $17.7 million in community wealth, up from $5.4 million at the end of 2016, according to Rose. He projects that total will surpass $35 million at the end of 2018.

The Land Bank reported $16.2 million in revenue during its 2017 fiscal year, which ended in November. That was up from $13.7 million in fiscal 2016, according to a Dec. 7 report.

The agency has a headcount of 12 and is funded by its revenue from property sales as well as grant money from the Metropolitan Water Reclamation District of Greater Chicago and proceeds from a community development block grant funded by the U.S. Department of Housing & Urban Development.

Cook County Land Bank Authority: A Gateway For Homeownership & Community Investment

By Mary L. Datcher, Chicago Defender | February 1, 2018 (Click here for the original article)

In 2010, Cook County Commissioner Bridget Gainer noticed something out of the ordinary—calls were coming in more frequently about constituents challenged with losing their homes. Aware of the housing market collapse and predator loan practices by banks, long-time home owners were seeking assistance from their public officials.

“People were calling me, they’re getting letters from the bank. People were worried if they had to move out that day—a lot of uncertainty. To be honest, the banks didn’t really know what to do. Half way through the foreclosure process, they realized they didn’t want all of these houses back, so what are we doing there? But, the compound had already started putting people out of their homes,” she remembers.

Growing up on the South Side in the Beverly community, Gainer began her career as a community organizer before entering into government. In order to equip people with resources to hopefully save their homes, she did a legal aid clinic in order for homeowners to know their rights. Working with Alderman Pat Dowell, a vacant lot ordinance was passed which forced banks who issued the mortgage to upkeep and secure the vacant property once the person walked away.

Growing up on the South Side in the Beverly community, Gainer began her career as a community organizer before entering into government. In order to equip people with resources to hopefully save their homes, she did a legal aid clinic in order for homeowners to know their rights. Working with Alderman Pat Dowell, a vacant lot ordinance was passed which forced banks who issued the mortgage to upkeep and secure the vacant property once the person walked away.

“In Cook County for the decades we used to have a minimum of 15,000 foreclosures per year. In 2009 to 2011, there was 45,000-55,000 during that time with the same number of judges… so if you had a foreclosure on a house, you used to be able to circulate it through the system and someone could buy it. Now it took at least 150 days to get a house out of foreclosure. So, it created this man-made barrier for regular people to buy houses, rehab and resale,” she explains. “We all know when a house sits vacant for a year, it gets stripped or it falls apart because it’s sitting in the winter.”

One day, both Gainer and Ald. Harris drove throughout the Chatham community looking at the houses. “She was taking me to all these homes that had become vacant. I literally remembered where we were. If there are vacant houses sitting in Chatham, then we are doomed. This is a solid neighborhood,” she thought.

Trying to find some kind of solution to a growing problem, she read about a land bank program in Flint, Mich. She recalls the neighborhoods were desirable and attractive where houses were being purchased through the land bank, so she reached out to the person who created the program. Taking money out of her county budget, Gainer hired him as a consultant to work on a similar program for Cook County.

Launching the Cook County Land Bank Authority (CCLBA) in 2013, it was two years in the works to identify vacant residential and commercial properties along with vacant lots that have carried back taxes and liens for years. The CCLBA acquires the properties, having the ability to wipe out taxes in order to sell them at below-market rates to qualified community-based developers who in turn rehab the homes and sometimes move-in.

Under the Homebuyer Direct Program roll-out in August 2017, properties in communities that have seen a considerable drop in residency such as Englewood, Auburn Gresham, East Chicago, Chicago Heights and other parts of Cook County offer consumers an opportunity to purchase and rehab these homes. Gainer says it’s simple.

“There’s a lot of people who can redevelop a house especially a single-family home. It’s not that complicated. There’s a lot fewer of those people that can go to court and hire a lawyer and put out money for all of that time before they can make any of that back. While all the talk from city hall or from the county building, ‘we want everyone to develop’. It was impossible for the average person.”

Rob Rose, CCLAB Executive Director, says it’s a  program that provides an opportunity for home buyers to become developers. “Our job is to be able to facilitate. Our job isn’t to go into any one neighborhood to tell them what to do. Nor is our job to hand out checks. What we do is remove the legal barriers but more importantly, we give access. If you think about programs like this in the past, it always boils down to if we’re going to do RFQ (Request for Quotation) or qualify the smaller group to take advantage of these programs,” he says. “Black people for the most part were left out or that one Black person will get all of the business on the South Side and so you inadvertently pick your winners and losers.”

program that provides an opportunity for home buyers to become developers. “Our job is to be able to facilitate. Our job isn’t to go into any one neighborhood to tell them what to do. Nor is our job to hand out checks. What we do is remove the legal barriers but more importantly, we give access. If you think about programs like this in the past, it always boils down to if we’re going to do RFQ (Request for Quotation) or qualify the smaller group to take advantage of these programs,” he says. “Black people for the most part were left out or that one Black person will get all of the business on the South Side and so you inadvertently pick your winners and losers.”

The CCLAB works independently from the Cook County Board earning revenue from the property sales and reinvesting into the budget to provide an infrastructure to provide additional resources for first-time home buyers and developers. In 2017, the program has generated nearly $18 million in earned program income, 20 percent over in 2016. Since the program began, 400 homes have been purchased and rehabbed.

Gainer says, “These neighborhoods are their own little ecosystems, let one of them fall and it weakens the whole infrastructure. For me was it was recognizing from the beginning, there’s a ton of people. There’s a ton of people who want to live those communities. We have just gotten in their way and we have to get rid of the nonsense.”

Going against the naysayers, Rose is proud of the accomplishments of the CCLBA as they enter into 2018 with a goal to acquire 600 properties.

“As the Land Bank was getting started, we were told these neighborhoods weren’t ready for redevelopment. Don’t be shocked or surprised if you have to rent out or maybe the Land Bank can rent them? It was this common theme of ‘sure the house can be rehabbed but who will actually buy them? Who wants to live there?’ What we’ve seen is that there are plenty of people who want to live there,” he said. “They are looking for quality rehabs, they’re looking for the barriers to be removed. If you can wipe away the back taxes, the code violations and address them in the rehab; the old mortgages and liens. You take all of that away and say, ‘here’s a house, can you make this work?’ It will open up all types of possibilities.”