Cook County Land Bank Authority Celebrates Its 200th Rehabilitated Home

By Craig Dellimore, CBS Chicago | November 20th, 2017 (Click here for the original article)

CHICAGO (CBS) — The Cook County Land Bank Authority celebrated Monday the 200th home that’s been rehabilitated under the innovative program.

Cook County Commissioner Bridget Gainer helped create the Land Bank after the 2008 subprime mortgage crisis. WBBM’s Political Editor Craig Dellimore reports.

She said most people did not have the expertise or ability to buy the homes vacated during the debacle.

She said most people did not have the expertise or ability to buy the homes vacated during the debacle.

“We built this thing called a land bank. We went into communities where homes were sitting vacant, we bought them up, cleared the titles…and then put them out on a really simple website where people could buy,” Gainer said.

And it is still going.

“So instead of having to go to court for nine months or a year, someone could just go on our website, they pick the house that they want and within 30-60 days they close on it,” Gainer said.

People get affordable homes, she said, and neighborhoods no longer have those abandoned homes as a blight on their communities.

The program began with money Attorney General Lisa Madigan obtained from lawsuits against the big mortgage servicing banks. But now, the program is self-sufficient and providing affordable homes.

County land bank unveils 200th rehabbed house

By Dennis Rodkin, Crain’s Business Chicago | November 20th, 2017 (Click here for the original article)

A stylishly rehabbed Chicago Lawn bungalow is the 200th formerly derelict home revitalized through the Cook County Land Bank, officials are announcing today, as the agency hits the benchmark a few months ahead of schedule.

“When we started, that goal of 200 homes seemed like a hairy, scary goal because nothing like this had been done in Chicago before,” said Rob Rose, executive director of the land bank, launched by the Cook County Board in 2013 to speed up the process of turning around the county’s huge inventory of foreclosed homes.

“When we started, that goal of 200 homes seemed like a hairy, scary goal because nothing like this had been done in Chicago before,” said Rob Rose, executive director of the land bank, launched by the Cook County Board in 2013 to speed up the process of turning around the county’s huge inventory of foreclosed homes.

Shortly after Rose came on in February 2015, the land bank announced the 200-homes goal, to be completed by February 2018.

“We fulfilled a commitment, and that’s important when you’re using (public) funds,” said Bridget Gainer, the Cook County Commissioner who chairs the land bank. “But more important is that 80 percent of these homes are returned to homeownership, and 65 percent of our developers are black and Latino, from the communities, so the money is recirculating in the neighborhoods we’re working in.”

The land bank’s initial funding was $20 million passed along by Illinois Attorney General Lisa Madigan from the state’s $1 billion share of a $25 billion national settlement with the five largest bank mortgage servicers. Gainer said the land bank became financially self-sufficient early in 2017, operating off its own revenue. The land bank will generate about $12 million in revenue this year and plow most of that into the next round of purchases of derelict properties, she said.

“We took no tax money in 2017,” Gainer said.

Work on the Chicago Lawn bungalow, at 6638 Artesian Ave., is about three weeks from completion, according to Bridgette Washington, whose firm Washington Realty & Investment is doing the project, her first-ever rehab job.

The house has all-new kitchen and bath fixtures, its formerly low-ceilinged attic bedrooms and the staircase up to them have been rebuilt at the full height required by building codes, and some main-floor walls have been removed to open up the floor plan to a more modern layout, Washington said.

The bungalow had been foreclosed in 2013 and deeded over to the land bank in 2014, according to the Cook County Recorder of Deeds. With partner Ricky Albritton, Washington bought the property from the land bank for $16,000. She plans to list it at $225,000 when the work is finished next month.

The land bank “made everything easy and convenient from the time I said I wanted to do this,” Washington said. Key to making it work, Gainer said, is that once the land bank acquires a foreclosure, it uses the county’s authority to wipe out any clouds on the title. That process “would take a developer nine months to a year and run up the attorneys’ fees,” Gainer said, while “we can make it happen fast.”

The land bank also helps small-operator developers like Washington line up financing, contractors and other resources. “We’re building a community of developers,” Rose said.

Cook County Land Bank To Sell Homes Directly To Homebuyers

By Corilyn Shropshire, Chicago Tribune | September 29th, 2017

A vacant brick bungalow on South Luella Avenue in Chicago’s South Shore neighborhood requires some work — in fact, quite a bit of work.

The orange kitchen, despite having a coveted island, needs updated appliances, new cabinetry and flooring. The toilet in the main floor bathroom is broken and the peach carpet smells of cats.

But for a prospective homebuyer looking for a house with good bones, the home has potential.

But for a prospective homebuyer looking for a house with good bones, the home has potential.

It’s just one of the 30 to 40 homes the Cook County Land Bank Authority is putting up for sale as part of a new program designed to promote homeownership by selling vacant, dilapidated, tax-delinquent homes directly to homeowners.

Until August, the land bank sold the properties it acquired only to developers that would rehab them and sell them at market rates.

But several of the land bank’s properties were more in need of cosmetic changes than complete rehabs. Rehabbers weren’t as interested in less-blighted properties because the projects would not produce the desired returns.

Enter the land bank’s new program designed to attract prospective owner-occupants with fixer-upper dreams.

“Most of the properties (offered to homebuyers) need cosmetic work, not a full gutting,” said Rob Rose, the land bank’s executive director. “These houses are great for a homeowner to come in, make that investment and build equity … because we’re selling to you below market.”

The homes range from $50,000 to $170,000. The South Luella Avenue bungalow is listed for $103,000. Six of the homes have sold since late September.

“What we love is getting the folks in the community to be the homeowners in those neighborhoods,” said Courtney Jones, president of the Dearborn Realtist Board, a trade association for black real estate professionals that supports the initiative to bring people back in to the neighborhood. “That allows the equity to stay with these people of color who’ve grown up in those areas.”

The land bank aims to make a long-term impact on neighborhoods hit hard by the housing crisis by filling abandoned homes with homeowners, not just renters, said Cook County Commissioner Bridget Gainer, D-Chicago, chairwoman of the land bank.

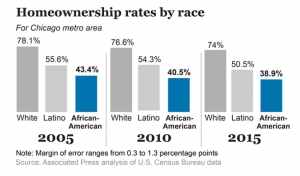

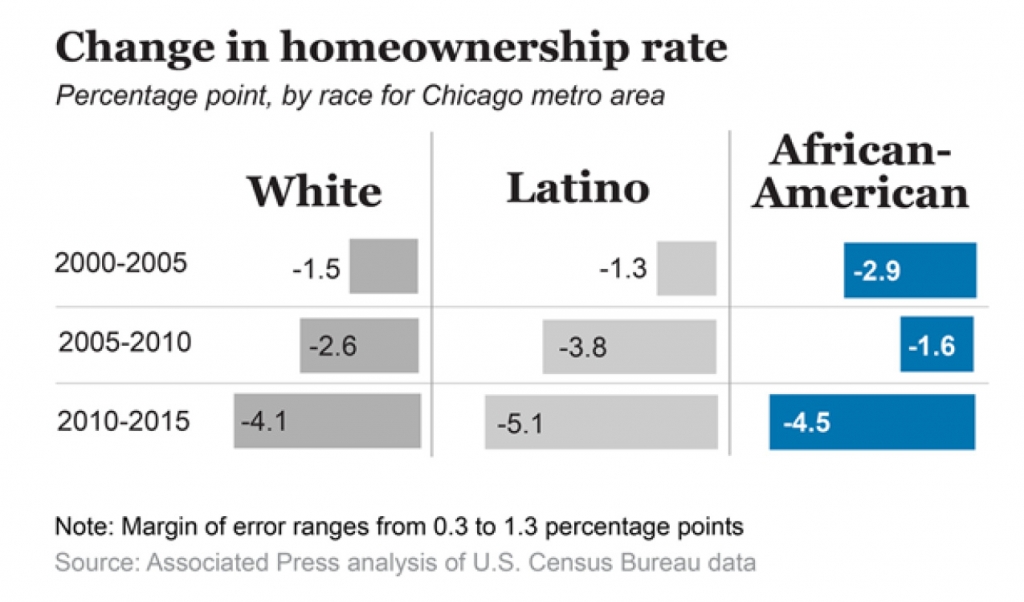

The initiative is also meant to boost homeownership among African-Americans, who are lagging behind whites in owning homes.

Only 38.9 percent of African-Americans owned home in the Chicago area in 2015, compared with 74 percent of whites, according to a report from Harvard University’s Joint Center for Housing Studies. Before the housing crash, almost half of African-Americans in the Chicago area owned homes.

Most of the homes in the land bank’s program are in Avalon Park, Roseland and South Shore. Some suburban properties are also available.

The land bank brought in corporate lenders offering purchase rehabilitation loans and is building a list of contractors to share with homebuyers.

“The main problem with these (vacant) buildings was man-made,” Gainer said. “Either it’s stuck in court, or the buyer couldn’t get credit. The houses are still desirable, people wanted to live there … so there needed to be a solution to unstick it.”

Since its founding in 2013, the land bank has identified 13 city neighborhoods and 13 west and south suburbs where it sees potential, and has been acquiring vacant homes to sell. The Chicago neighborhoods are Auburn Gresham, Austin, Chatham, Chicago Lawn, East Garfield Park, Gage Park, Grand Boulevard, Great Grand Crossing, Humboldt Park, South Shore, Washington Heights, Washington Park and Woodlawn. It is working to expand to more neighborhoods.

As of the end of August, the land bank had acquired 538 properties. Of those, 346 homes have been sold to developers and 167 have been rehabbed.

Wait, did you just say you WAIVED all the taxes?

By Rooted In Chicago, Chicago Now | August 13th, 2017

Ever notice a nice-looking house or building which has been vacant for years and no one seems to know why? You might assume that even though the outside of the structure is attractive, surely the inside must be a wreck (busted pipes, moldy walls, nests of raccoons and possums swapping stories about the good old days, etc). Surprisingly, this is often not the case. If structure has been winterized and properly sealed up to keep out the elements, it can sometimes sit vacant for years while experiencing only an insignificant amount of interior damage.

Did you know that sometimes the only thing that keeps a nice structure out of circulation is PAPERWORK? We’re talking back taxes, liens, and encumbrances which scare away homebuyers and even the most stout-hearted of investors. This is where agencies like the Cook County Land Bank Authority (CCLBA) step in and work their Hogwarts magic. They have the power to waive all the taxes, water bills, receivership liens, etc. and give the property a tabula rasa to make it more desirable to buyers. And THAT is why they have earned the right to put the word “authority” in their name. CCLBA is a boss. Boom!

Did you know that sometimes the only thing that keeps a nice structure out of circulation is PAPERWORK? We’re talking back taxes, liens, and encumbrances which scare away homebuyers and even the most stout-hearted of investors. This is where agencies like the Cook County Land Bank Authority (CCLBA) step in and work their Hogwarts magic. They have the power to waive all the taxes, water bills, receivership liens, etc. and give the property a tabula rasa to make it more desirable to buyers. And THAT is why they have earned the right to put the word “authority” in their name. CCLBA is a boss. Boom!

“Land banks, as defined by the Center for Community Progress, are governmental entities or special-purpose nonprofit corporations that acquire problem properties, eliminate liabilities, then transfer the properties to new owners. The goal is to return the properties to productive use—and to the tax rolls—in accordance with community goals. Land banks often have special powers, including the ability to obtain property at low or no cost through the tax foreclosure process and to hold land tax-free, according to the center’s 2014 report Take It to the Bank.”

– An article posted on the CCLBA website titled “Land Banks Helping Rebuild From Legacy of Foreclosure”

But if you are like me you always want to know “What is the catch? Why would our cash-strapped local government give up on trying to collect legitimate taxes owed a property?” Here’s the dirty little secret: the government (local, state, federal) will bend over backwards to help renters transition to buyers because it generates more taxes. But if the only catch to having the opportunity to live in a place I can call my own is to pay taxes, then WHATEVER! That’s an easy decision. I’ll take it! The decision makers have resolved that they’ll never collect those back taxes anyway so why not cut their loses and offer a chance to a new owner? Check out this Next City article,”Chicago’s Land Bank Will Use Big Data to Target Vacant Homes.“

I have known about this program for a while, but what I learned more about on the Auburn Gresham trolley tour was how excellent this program really is. CCLB has launched a new Homebuyer Direct Program. The website says “the focus of this program lies in reaching out to prospective homeowners who may be interested in directly purchasing, rehabbing and ultimately living in the home of their dreams!…

[T]he CCLBA is looking to offer properties throughout Cook County to prospective owner-occupants at below-market prices. This could be a perfect opportunity for you to engage in the purchase/rehab, finish it to your taste, and build in some equity!”

I’ll share more with you about the CCLBA on Wednesday. Whether you’re a homebuyer or investor, you don’t want to miss these important details about how this great program can benefit your life.

[T]he CCLBA is looking to offer properties throughout Cook County to prospective owner-occupants at below-market prices. This could be a perfect opportunity for you to engage in the purchase/rehab, finish it to your taste, and build in some equity!”

I’ll share more with you about the CCLBA on Wednesday. Whether you’re a homebuyer or investor, you don’t want to miss these important details about how this great program can benefit your life.

Land Banks Helping Rebuild From Legacy of Foreclosure

By Brett Widness, Urban Land Institute | August 9th, 2017

For more than a decade, the brick “two-flat” on the 900 block of North Drake Avenue on Chicago’s West Side had been vacant. During the housing boom, a contractor began converting the building, a two-story detached home with two separate apartments and a basement, into a three-unit condominium, with plans to develop the basement level into a garden unit. But the job was never finished, the property was abandoned, and the condo units fell into foreclosure.

Neighbors said the property became a hangout for heroin addicts, evidenced by the needles strewn in the yard and under the back porch. Residents called police regularly to report issues, and the neglected building had a variety of safety problems and structural concerns.

Neighbors said the property became a hangout for heroin addicts, evidenced by the needles strewn in the yard and under the back porch. Residents called police regularly to report issues, and the neglected building had a variety of safety problems and structural concerns.

But by the time the school year begins this fall, the West Humboldt Park home will have a new occupant. A first-time homeowner plans to move in after renovations are completed, says John Groene, neighborhood director of the West Humboldt Park office of Neighborhood Housing Services (NHS) of Chicago, a nonprofit neighborhood revitalization organization. The homeowner plans to live on one floor and rent out the other.

The change will have an immediate impact on the block. “Vacant buildings, if nothing else, are magnets for crime. There is crime in some blocks in Chicago only because there are vacant buildings that make it attractive for crime to happen there,” Groene says.

A major reason for this property’s happy ending is the involvement of a land bank that acquired the building and wiped out its back taxes and encumbrances, making it easier for someone to purchase the property and improve it, Groene says. The number of land banks throughout the country rose exponentially in the aftermath of the foreclosure crisis.

“This would have sat for another ten years or have been demolished, there were so many encumbrances against the title,” says Robert Rose, executive director of the Cook County Land Bank Authority (CCLBA). CCLBA acquired the abandoned property via forfeiture and was able to remove $60,000 to $70,000 of tax, water, and receivership costs. From there, NHS purchased the building and had a first-time homebuyer under contract within a month, Groene says.

Land banks, as defined by the Center for Community Progress, are governmental entities or special-purpose nonprofit corporations that acquire problem properties, eliminate liabilities, then transfer the properties to new owners. The goal is to return the properties to productive use—and to the tax rolls—in accordance with community goals. Land banks often have special powers, including the ability to obtain property at low or no cost through the tax foreclosure process and to hold land tax-free, according to the center’s 2014 report Take It to the Bank.

Though land banks have been around for decades, they gained popularity in recent years as communities sought ways to deal with vast numbers of vacant, abandoned, and tax-delinquent properties, according to the report. The center now estimates there are more than 170 land banks throughout the country, and more than 70 percent of those land banks were established after 2008.

Many of these land banks are seeing results, says Kim Graziani, vice president and director of national technical assistance at the Center for Community Progress.

“Working alongside the community and particularly those residents most impacted by vacancy and abandonment, land banks can be an essential element to unlocking valuable land to achieve community goals,” Graziani says. “Land banks are most effective when they have the legal authority to intervene in those properties that are stuck in decline and inaccessible to the private market. Land banks often acquire properties that are underwater in value, have tangled title issues, and are caught in bureaucratic processes.”

The CCLBA has sold 327 properties it has acquired since its inception in 2013. A total of 133 rehabs have been completed, and 101 rehabbed buildings have been occupied by homeowners, Rose says. Meanwhile, 166 rehabs are underway, and 28 vacant lots are being developed, he adds.

The properties are acquired from Fannie Mae, Freddie Mac, and the U.S. Department of Housing and Urban Development, as well as through the court system, Rose says. Sometimes, the authority receives donations from banks and private citizens. The land bank also buys properties through county scavenger sales, which allows for the purchase of properties with tax delinquencies, he says.

In addition to making it easier for people to purchase and renovate problem properties, the land bank demolishes properties when that is the best course of action and also has been instrumental in helping improve the use of vacant lots—for community gardens and pocket parks, as well as side lots or garages for current homeowners, Rose says.

It also acquired and found buyers for four abandoned warehouses in the Chicago suburb of Bellwood, which are now occupied by a local woodworking company that makes cabinets and furniture, a rug importer, a printing company, and a vertical farming operation that employs troubled youths as well as ex-convicts, Rose says.

“It’s not just about single-family homes and getting them rehabbed,” he says. “It’s really about redevelopment for the region.”

In Cleveland, the Cuyahoga Land Bank has facilitated renovation of 1,500 properties since its creation in 2009, Gus Frangos, land bank president and general counsel, said during a recent talk at the City Club of Cleveland. It also has demolished about 5,500 blighted, often crime-infested properties. Sometimes demolition is the best remedy for problem properties that are far beyond repair, he said.

In Syracuse, New York, clusters of lots left vacant by demolition by the local land bank are now attracting the attention of developers, says Kaitlyn Wright, executive director of the Greater Syracuse Land Bank. “It’s helping shift demand in these neighborhoods,” she says.

The problem of abandoned properties in Syracuse predated the foreclosure crisis, Wright says. Decades ago, residents began fleeing to the suburbs and the number of manufacturing jobs started to dwindle, depressing housing prices. During the five years it has been in operation, the land bank has sold 450 properties it acquired, she says.

Many of the properties had confusing webs of complicated title issues, Wright says. When the land bank takes title to an abandoned property in the area, it is able to put a for-sale sign on it—and sometimes that is enough to attract a buyer, she says.

One example: a sign in front of a home in the Courtwood Lawn neighborhood caught the attention of a Vietnamese immigrant who lived across the street with in-laws. He and his wife transformed the shotgun-style house, gutting it and modernizing the interior to make a home for their family, which included children who could walk to the local elementary school.

“To finally have a house of his own was a dream come true,” says Wright.

Many recently formed land banks are still determining how much work they can take on and the best routes to getting results.

At the CCLBA, Rose says his office has the feel of a startup as it discovers how far it can go. For example, it has not yet helped turn around a block with six or seven abandoned properties; someday that may be a possibility, he says.

“We are exploring those boundaries in real time, and that’s exciting,” he says.

Why Black Homeownership Rates Lag Even As The Housing Market Recovers

By Gail MarksJarvis, Chicago Tribune | July 21st, 2017