By Gail MarksJarvis, Chicago Tribune | July 21st, 2017

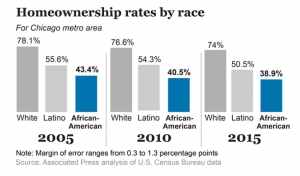

And in Chicago, the gap between black and white homeownership rates is even more extreme. Only 38.9 percent of African-Americans owned homes in the Chicago area in 2015, compared with 74 percent of whites. Before the housing crash, almost half of African-Americans in the Chicago area owned homes, according to Harvard’s research. Latinos in the Chicago area also lag when it comes to homeownership. Only 50.5 percent of Latinos owned homes in the area in 2015.

And in Chicago, the gap between black and white homeownership rates is even more extreme. Only 38.9 percent of African-Americans owned homes in the Chicago area in 2015, compared with 74 percent of whites. Before the housing crash, almost half of African-Americans in the Chicago area owned homes, according to Harvard’s research. Latinos in the Chicago area also lag when it comes to homeownership. Only 50.5 percent of Latinos owned homes in the area in 2015. Without homes, blacks lack a powerful source of wealth creation, said Jonathan Spader, senior research associate with the Harvard center. Homeowners generally build equity that allows them to eventually buy other homes or businesses and send children to college. Homes also are passed to younger generations upon death, allowing future generations to build wealth.

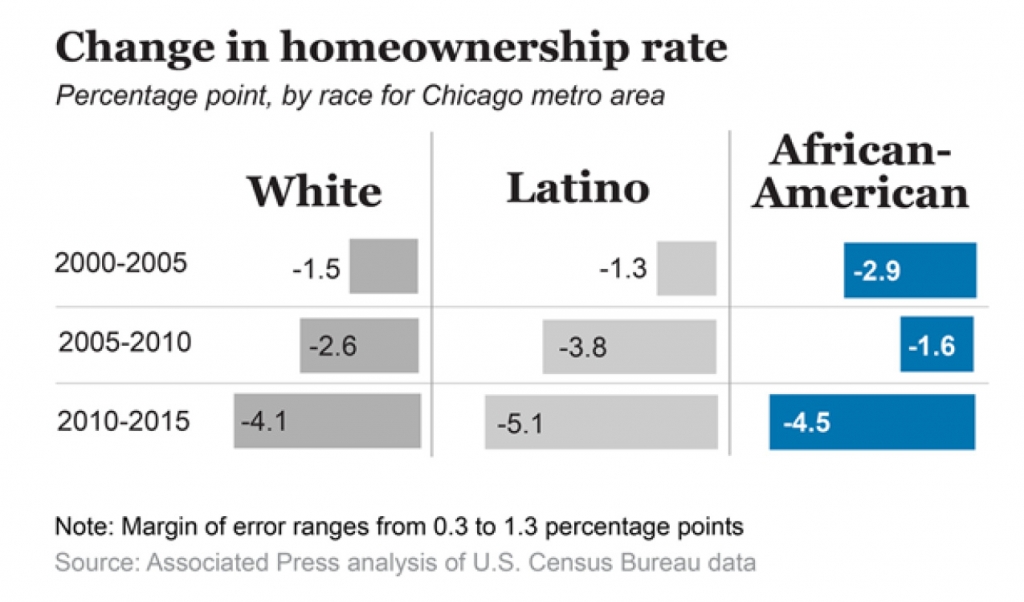

Without homes, blacks lack a powerful source of wealth creation, said Jonathan Spader, senior research associate with the Harvard center. Homeowners generally build equity that allows them to eventually buy other homes or businesses and send children to college. Homes also are passed to younger generations upon death, allowing future generations to build wealth. Credit scores damaged by foreclosures and short sales kept people from bargain-hunting in the wake of the housing crash, even though prices were low, according to Urban Institute research. Even people with good credit struggled to get mortgages as lenders focused on borrowers with pristine credit, the Urban Institute has found.

Credit scores damaged by foreclosures and short sales kept people from bargain-hunting in the wake of the housing crash, even though prices were low, according to Urban Institute research. Even people with good credit struggled to get mortgages as lenders focused on borrowers with pristine credit, the Urban Institute has found.